How To Calculate Unemployment For Reduced Hours

In every state however benefit amounts are based on prior earnings. Your weekly benefit amount is 270 and your weekly wages earned before taxes from your part-time job are 120.

U S Economy Finishes The Year Strong Economy Labour Market Chart

This program is for employees whose employers.

How to calculate unemployment for reduced hours. The Unemployment Insurance UI benefit calculator will provide you with an estimate of your weekly UI benefit amount which can range from 40 to 450 per week. See the chart below for. If you are still making more money than your Weekly Benefit Amount as listed on your monetary determination letter then simply do not certify as you are still considered employed.

Unemployment Rate is calculated using the formula given below. 10-20 Hours 2 days. 31 Hours 4 days.

Youll also need to gain their agreement on the new hours you have. 21 30 hours of work 3 days worked. Of Unemployed Persons Non-Institutionalized Civilian Population Volunteers Discouraged Workers Not Actively Seeking Jobs During Last 4 Weeks No of Employed Persons.

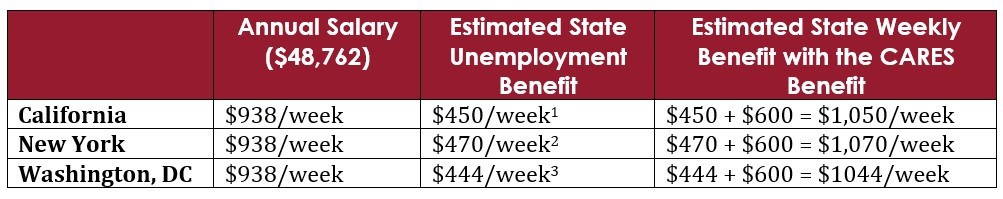

After this with the process finalised you can update their contract and provide them with a written notice of the change. In most states people who still are employed may qualify for partial unemployment benefits if their employers drastically cut their work hours due to lack of work. 0 reduction so you receive 100 of your weekly benefit amount.

25 reduction so you receive 75 of your weekly benefit amount. 50 of weekly benefit rate. 450 minus 75 of 320 240 210.

Some states use the applicants average earnings over a one-year period to calculate benefits. 5-10 Hours 1 day. Out of this total population 1514 million were classified as.

The wage and other entitlements shall be granted on a pro-rata basis. To calculate your reduced benefit you subtract 25 of your wages then subtract that amount from your maximum benefit. Reduced hours might qualify someone for unemployment.

No reduction in weekly benefit rate 5 10 hours of work 75 of weekly benefit rate 11 20 hours of work 50 of weekly benefit rate 21 30 hours of work 25 of weekly benefit rate 31 hours of work 0 of weekly benefit rate Cannot earn more than the maximum benefit amount 504 WBA. 0-4 Hours 0 days. And its important to remember you keep your employees well informed during the process.

And others use another method. We recommend that you go ahead and file the claim. Based on hours worked.

We can calculate the unemployment rate by dividing the number of unemployed people by the total number in the labor force then multiplying by 100. If the claimants gross earnings. So for someone who gets the maximum weekly benefit amount of 450 would be paid a reduced.

Employees who have their hours reduced may be eligible for partial unemployment benefits typically a portion of the pay that they would have received if they were fully unemployed. This is called the Weekly Benefit Amount WBA and will usually be calculated by dividing the earnings for the highest paid quarter of the base period four previous calendar quarters after a one quarter lag period by 26. Others use the applicants average earnings in the highest paid quarter of the base period.

Each state has its own formula for calculating unemployment benefits including partial benefits. 4 or fewer hours of work 0 days worked. If a minimum wage full time employees hours are reduced to 20 hours the employee would have to report three days of work assuming eight hour shifts and would see a decrease in their weekly unemployment benefit from 281 to 7025 or 14 of the weekly benefit rate.

For the reduction in working hours employment law does require you to provide a legitimate reason. 0 of weekly benefit rate. 50 reduction so you receive 50 of your weekly benefit amount.

Calculate your earnings disregard. Unemployment benefits help people who are laid off support themselves while they search for a new job. If you are on temporary layoff or work reduction you may be eligible for benefits under Californias partial benefit program.

75 reduction so you receive 25 of your weekly benefit amount. The total adult working-age population in 2016 was 2535 million. Where a claimant is working less than his full-time hours and his gross earnings for a week are equal to or less than the PBC the claimants full WBR is payable for the week.

25 of weekly benefit rate. You would earn 210 per week. For example if you earned 100 in a week the CA EDD would not count the first 25 of your wages against your UI benefit and would only deduct 75 from your weekly benefit amount.

75 of weekly benefit rate. 5 10 hours of work 1 day worked. Before agreeing to work on reduced hours the conditions of work applicable for full-time.

31 hours of work 4 days worked. Of Unemployed Persons 1500000 50000 170000 40000 1150000. Full-time employment with reduced hours is employment in respect of which social security contributions are payable and when the employee agrees with hisher employer to work less hours than those worked by a comparable full-timer.

For more information refer to How Unemployment Insurance. 11 20 hours of work 2 days worked. Keep in mind that employees who quit as a result of a significant reduction in hourspay may also be eligible for unemployment benefits.

The current base period is the four quarters of 2019. 21-30 Hours 3 days. Once you file your claim the EDD will verify your eligibility and wage information to determine your weekly benefit amount WBA.

Employed Unemployed and Out of the Labor Force Distribution of Adult Population age 16 and older 2016. When the claimants gross earnings for a week exceed the PBC the gross earnings are deducted from the sum of the WBR plus PBC to determine the amount of any partial benefits for which the claimant may be eligible.

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Esdwagov Calculate Your Benefit

Unemployment Benefit Calculator Cares Act

3 Important Calculations Every Marine Engineer Must Know On Ships Marine Engineering Merchant Navy

Unemployment Benefit In The Netherlands What You Need To Know 2021 Dutchreview

Esdwagov Calculate Your Benefit

Dog Birth Certificate Template Free Beautiful What S In A Name Dannybarrantes Template Letter Templates Letter Sample Cover Letter Template

Unemployment Benefit In The Netherlands What You Need To Know 2021 Dutchreview

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Beroepkunstenaar Nl Unemployment Benefit Ww

The Impact Of The Covid 19 Pandemic On The Euro Area Labour Market

Unemployment Insurance Rate Information Department Of Labor

U S Economy Finishes The Year Strong Economy Labour Market Chart

How To Calculate Amount Of Unemployment In Ohio 9 Steps

5 Realities Of This Recession Capital Group Charts And Graphs Practice Management Reality

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Post a Comment for "How To Calculate Unemployment For Reduced Hours"