How Much Mortgage Can I Afford Ontario Calculator

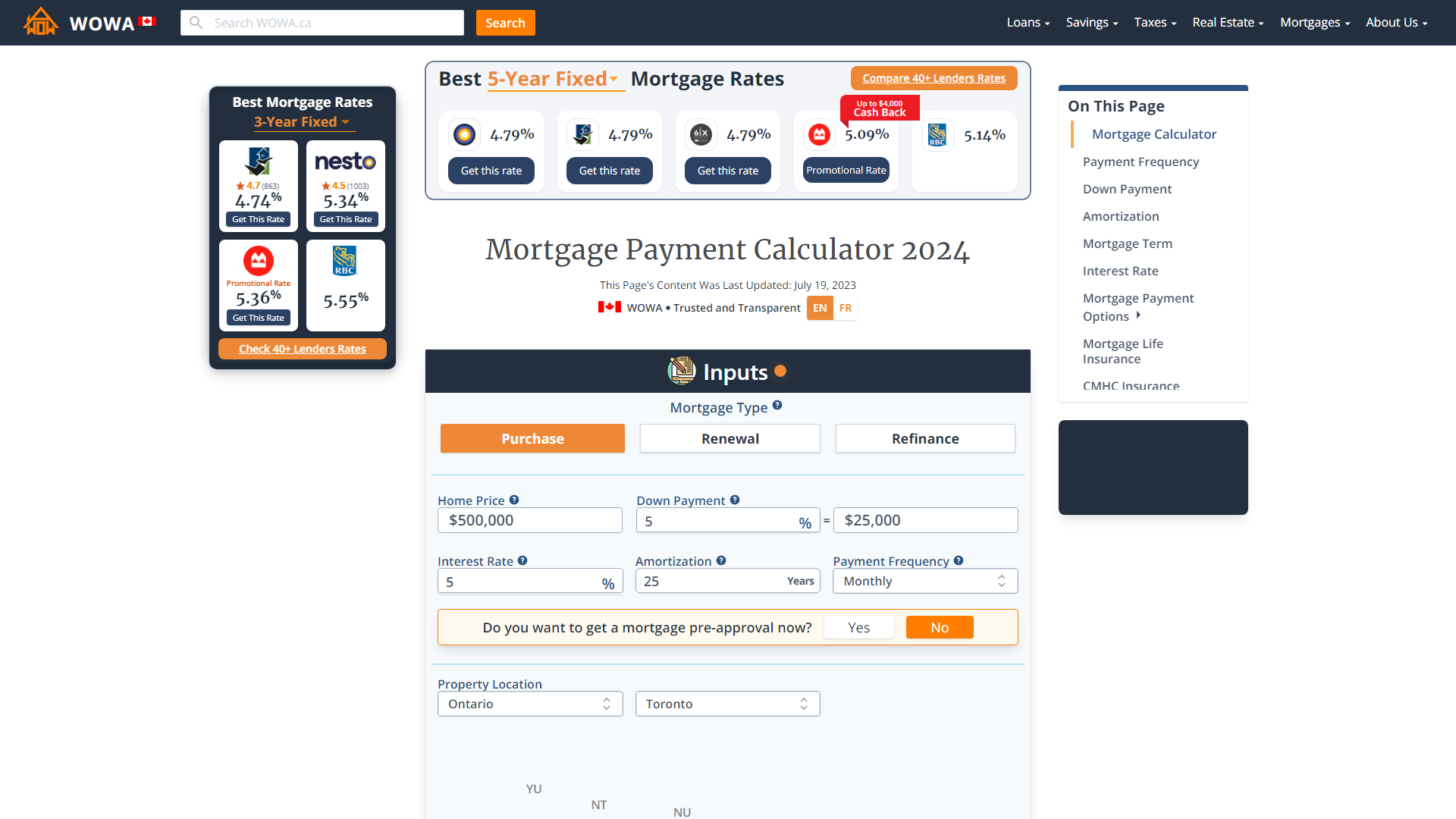

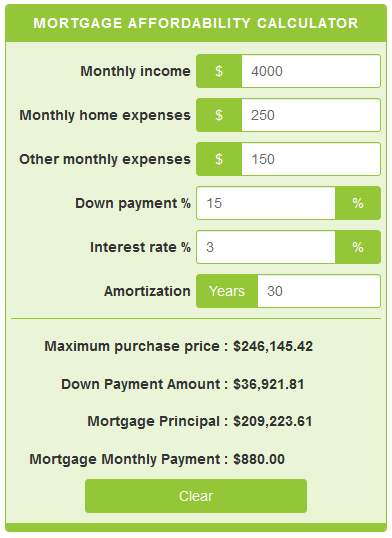

Simply enter your monthly income expenses and expected interest rate to get your estimate. Includes mortgage default insurance premium of 669302 For the purposes of this tool the default insurance premium figure is based on a premium rate of 40 of the mortgage amount which is the rate applicable to a loan-to-value ratio of 9001 9500.

In Just 4 Simple Steps This Free Mortgage Calculator Will Show You Your Monthly Mortgage P Free Mortgage Calculator Mortgage Calculator Mortgage Interest Rates

Table of the breakdown of the maximum home price that you can afford by loan amount and down payment.

How much mortgage can i afford ontario calculator. For homes that cost more than 1 million a down payment of 20 is required. While every effort is made to keep this tool up-to-date CMHC does not guarantee the accuracy reliability or completeness of any information or calculations provided by this calculator. Use the TD Mortgage Affordability Calculator to determine a comfortable mortgage loan and price range for your new home.

How much mortgage can I afford. When it comes to getting a mortgage in Ontario having a reliable mortgage calculator gives you some certainty ahead of time. Quickly find the maximum home price within your price range.

Discover how TD can. Simple calculations can help you determine your mortgage affordability and other costs. Our mortgage affordability calculator helps you calculate your maximum purchasing price to help you plan ahead and understand your buying power.

The calculator helps determine how much you can afford based on your yearly incomealong with the income of anyone else purchasing a home with you and your monthly expenses. Use our VA home loan calculator to estimate how expensive of a house you can afford. This calculator helps you determine whether or not you can qualify for a home mortgage based on income and expenses.

To qualify for a mortgage loan at a bank you will need to pass a stress test. Mortgage Qualifier Tool. For homes that cost over 1000000 the minimum down payment is 20.

To help answer this our Mortgage Affordability Calculator is a great starting point. CMHC is not be liable for loss or damage of any kind arising from the use of this tool. In order to be approved for a mortgage you will need at least 5 of the purchase price as a down payment if your purchase price is within 500000.

For a purchase price between 500000 and 1 million the minimum down payment is 5 on the first 500000 and 10 on the balance. Amortization can only be entered in full years not months or partial years Mortgage amount is rounded to the nearest 1000 A minimum 5 down payment is required for a purchase price of 500000 or less. So if you make 3000 a month 36000 a year you can afford a house with monthly payments around 1230 3000 x 041.

For homes that cost between 500000 and 1000000 the minimum down payment is 5 of the first 500000 plus 10 of the remaining balance. TD calculates your mortgage limit using the current qualification rate and a maximum gross debt service GDS ratio of 35 and a maximum total debt service TDS ratio of 42. If your purchase price is between 500000 and 1000000 your minimum down payment is 5 of the first 500000 and 10 of the price between 500000 and 1000000.

Adjust the loan terms to see your estimated home price loan amount down payment and monthly payment change as. Canada Mortgage Qualification Calculator The first steps in buying a house are ensuring you can afford to pay at least 5 of the purchase price of the home as a down payment and determining your budget. Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments.

It takes about five to ten minutes. The first step in buying a property is knowing the price range within your means. You will need to prove you can afford payments at a qualifying interest rate.

From Financial Consumer Agency of Canada. This rule is based on your debt service ratios. Using the calculator on this page you can work out your monthly payments total interest paid as well as the impact of taking out a different size.

This means that your mortgage payment property tax heating costs and half of your condo fees if applicable cannot take up more than 35 of your gross income. For down payments of less than 20 home buyers are required to purchase mortgage default insurance. This calculator steps you through the process of finding out how much you can borrow.

Home Affordability Calculator Estimate how much home you can afford with our affordability calculator. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load including housing costs is no more than 40 of your gross houshold income. A mortgage pre-qualification is a rough estimate of your borrowing capacity to purchase a property.

Offset calculator see how much you could save. Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a mortgage pre-approval.

With VA loans your monthly mortgage payment and recurring monthly debt combined should not exceed 41. This calculator is for illustrative purposes only. Lenders also generally require that your monthly housing expenses alone be less than 39 of your gross monthly income.

Private mortgage insurance PMI 1247 67 percent. Affordability calculator get a more accurate estimate of how much you could borrow from us. Its calculated based on your basic financial information such as your income and.

222 Artemesia St Grey Highlands Ontario N0c1k0 Mortgage Calculator In Mortgagecalculator Mortgage M Mortgage Calculator Mortgage Real Estate Professionals

Home Buying Checklist Infographic Infographic Post Home Buying Checklist Buying Your First Home Home Buying Process

Mortgage Payment Calculator For All Canadian Provinces Wowa Ca

Scholarship Partners Canada Universities Canada Mortgage Payment Calculator Mortgage Loans Mortgage Payment

Mortgage Calculator Use Our Online Mortgage Calculator To Get An Idea About Mortgage Amortization Calculator Free Mortgage Calculator Mortgage Calculator Tools

Mortgage Calculator You Thinking Of Buying A Home Find Out How Much You Can Afford Its Mortgage Loan Calculator Mortgage Amortization Free Mortgage Calculator

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal Mortg Mortgage Loan Calculator Mortgage Refinance Calculator Mortgage Payment Calculator

Mortgage Calculator Everything You Need To Know 2021

Online Mortgage Calculator What Is My Mortgage Payment Calculator Valoan Vam Monthly Mortgage Mortgage Payment Calculator Online Mortgage Mortgage Payment

How Much Mortgage Can I Afford Ratehub Ca

The Mortgage Process What You Need To Know Infographic Do Your Research Re Mortgage Process Mortgage Infographic Real Estate Buyers

First And Second Mortgage Calculator Mls Mortgage Mortgage Refinance Calculator Second Mortgage Mortgage Amortization Calculator

How Much Should You Spend On Monthly Home Costs Calculate It With This Download Calculators Ideas Of Buying First Home Home Buying Buying Your First Home

The Mortgages Calculator Is The Feature Which Is Providing By Us The Mortgages Paym Mortgage Amortization Calculator Mortgage Amortization Buy To Let Mortgage

Mortgage Affordability Calculator Calculatorscanada Ca

Calculate The Monthly Mortgage Payment Your Household Can Afford Using Simple Information Like Income Mo Mortgage Payment Calculator Mortgage Payment Mortgage

Mortgage Tips And Tricks How A Mortgage Calculator Can Save You Bundles Of Dave Ramsey Mortgage Mortgage Payoff Pay Off Mortgage Early

Post a Comment for "How Much Mortgage Can I Afford Ontario Calculator"